- Home

- Blog

- Political-economy

- Political-economy

Political-economy

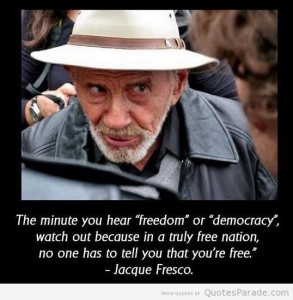

Jacque Fresco : An Obsolete Monetary System -1

05/02/2015

Jacque Fresco : An Obsolete Monetary System - 1

An Obsolete Monetary System

The money-based system evolved centuries ago. All of the world's economic systems - socialism, communism, fascism, and even the vaunted free enterprise system - perpetuate social stratification, elitism, nationalism, and racism, primarily based on economic disparity. As long as a social system uses money or barter, people and nations will seek to maintain the economic competitive edge or, if they cannot do so by means of commerce they will by military intervention. We still utilize these same outmoded methods.

Our current monetary system is not capable of providing a high standard of living for everyone, nor can it ensure the protection of the environment because the major motive is profit. Strategies such as downsizing and toxic dumping increase the profit margin. With the advent of automation, cybernation, artificial intelligence and out sourcing, there will be an ever-increasing replacement of people by machines. As a result, fewer people will be able to purchase goods and services even though our capability to produce an abundance will continue to exist.

Our present, outmoded political and economic systems are unable to apply the real benefits of today's innovative technology to achieve the greatest good for all people, and to overcome the inequities imposed upon so many. Our technology is racing forward yet our social designs have remained relatively static. In other words cultural change has not kept pace with technological change. We now have the means to produce goods and services in abundance for everyone.

Unfortunately, today science and technology have been diverted from achieving the greatest good for reasons of self-interest and monetary gain through planned obsolescence sometimes referred to as the conscious withdrawal of efficiency. For example, the U. S. Department of Agriculture, whose function is presumed to be conducting research into ways of achieving higher crop yields per acre, actually pays farmers not to produce at full-capacity. The monetary system tends to hold back the application of these methods that we know would best serve the interests of people and the environment.

In a monetary system purchasing power is not related to our capacity to produce goods and services. For example, during a depression, there are computers and DVD's on store shelves and automobiles in car lots, but most people do not have the purchasing power to buy them. The earth is still the same place; it is just the rules of the game that are obsolete and create strife, deprivation and unnecessary human suffering.

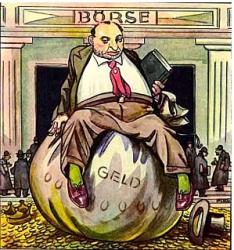

A monetary system developed years ago as a device to control human behavior in an environment with limited resources. Today money is used to regulate the economy not for the benefit of the general populace, but for those who control the financial wealth of nations.

Resource Based Economy

All socio-economic systems, regardless of political philosophy, religious beliefs, or social customs, ultimately depend upon natural resources, i.e. clean air and water, arable land and the necessary technology and personnel to maintain a high standard of living.

Simply stated, a resource-based economy utilizes existing resources rather than money and provides an equitable method of distributing these resources in the most efficient manner for the entire population. It is a system in which all goods and services are available without the use of money, credits, barter, or any other form of debt or servitude.

Earth is abundant with plentiful resources; today our practice of rationing resources through monetary methods is irrelevant and counter productive to our survival. Modern society has access to highly advanced technologies and can make available food, clothing, housing, medical care, a relevant educational system, and develop a limitless supply of renewable, non-contaminating energy such as geothermal, solar, wind, tidal, etc. It is now possible to have everyone enjoy a very high standard of living with all of the amenities that a prosperous civilization can provide. This can be accomplished through the intelligent and humane application of science and technology.

To better understand the meaning of a resource-based economy consider this: if all the money in the world were destroyed, as long as topsoil, factories, and other resources were left intact, we could build anything we choose to build and fulfill any human need. It is not money that people need; rather, it is free access to the necessities of life. In a resource-based economy , money would be irrelevant. All that would be required are the resources and the manufacturing and distribution of the products.

When education and resources are made available to all people without a price tag, there would be no limit to the human potential. Although this is difficult to imagine, even the wealthiest person today would be far better off in a resource based society as proposed by The Venus Project. Today the middle classes live better than kings of times past. In a resource based economy everyone would live better than the wealthiest of today.

In a resource based society, the measure of success would be based on the fulfillment of one's individual pursuits rather than the acquisition of wealth, property and power.

The Choice Is Ours To Make

Human behavior is subject to the same laws as any other natural phenomenon. Our customs, behaviors, and values are byproducts of our culture. No one is born with greed, prejudice, bigotry, patriotism and hatred; these are all learned behavior patterns. If the environment is unaltered, similar behavior will reoccur.

Today, much of the technology needed to bring about a global Resource Based Economy exists. If we choose to conform to the limitations of our present monetary-based economy, then it is likely that we will continue to live with its inevitable results: war, poverty, hunger, deprivation, crime, ignorance, stress, fear, and inequity. On the other hand, if we embrace the concept of a global resource-based economy , learn more about it, and share our understanding with our friends, this will help humanity evolve out of its present state.

Organisation supportrice en France :

Association Civilisation 2.0 - http://www.civilisation2.com

Sources : https://www.thevenusproject.com/en/store/official#!/~/product/category=1360103&id=5501756

https://www.thevenusproject.com/en/about/resume

Yves Herbo-MPSA, 13-01-2015

Jacque Fresco : An Obsolete Monetary System -1

13/01/2015

Jacque Fresco : An Obsolete Monetary System - 1

An Obsolete Monetary System

The money-based system evolved centuries ago. All of the world's economic systems - socialism, communism, fascism, and even the vaunted free enterprise system - perpetuate social stratification, elitism, nationalism, and racism, primarily based on economic disparity. As long as a social system uses money or barter, people and nations will seek to maintain the economic competitive edge or, if they cannot do so by means of commerce they will by military intervention. We still utilize these same outmoded methods.

Our current monetary system is not capable of providing a high standard of living for everyone, nor can it ensure the protection of the environment because the major motive is profit. Strategies such as downsizing and toxic dumping increase the profit margin. With the advent of automation, cybernation, artificial intelligence and out sourcing, there will be an ever-increasing replacement of people by machines. As a result, fewer people will be able to purchase goods and services even though our capability to produce an abundance will continue to exist.

Our present, outmoded political and economic systems are unable to apply the real benefits of today's innovative technology to achieve the greatest good for all people, and to overcome the inequities imposed upon so many. Our technology is racing forward yet our social designs have remained relatively static. In other words cultural change has not kept pace with technological change. We now have the means to produce goods and services in abundance for everyone.

Unfortunately, today science and technology have been diverted from achieving the greatest good for reasons of self-interest and monetary gain through planned obsolescence sometimes referred to as the conscious withdrawal of efficiency. For example, the U. S. Department of Agriculture, whose function is presumed to be conducting research into ways of achieving higher crop yields per acre, actually pays farmers not to produce at full-capacity. The monetary system tends to hold back the application of these methods that we know would best serve the interests of people and the environment.

In a monetary system purchasing power is not related to our capacity to produce goods and services. For example, during a depression, there are computers and DVD's on store shelves and automobiles in car lots, but most people do not have the purchasing power to buy them. The earth is still the same place; it is just the rules of the game that are obsolete and create strife, deprivation and unnecessary human suffering.

A monetary system developed years ago as a device to control human behavior in an environment with limited resources. Today money is used to regulate the economy not for the benefit of the general populace, but for those who control the financial wealth of nations.

Resource Based Economy

All socio-economic systems, regardless of political philosophy, religious beliefs, or social customs, ultimately depend upon natural resources, i.e. clean air and water, arable land and the necessary technology and personnel to maintain a high standard of living.

Simply stated, a resource-based economy utilizes existing resources rather than money and provides an equitable method of distributing these resources in the most efficient manner for the entire population. It is a system in which all goods and services are available without the use of money, credits, barter, or any other form of debt or servitude.

Earth is abundant with plentiful resources; today our practice of rationing resources through monetary methods is irrelevant and counter productive to our survival. Modern society has access to highly advanced technologies and can make available food, clothing, housing, medical care, a relevant educational system, and develop a limitless supply of renewable, non-contaminating energy such as geothermal, solar, wind, tidal, etc. It is now possible to have everyone enjoy a very high standard of living with all of the amenities that a prosperous civilization can provide. This can be accomplished through the intelligent and humane application of science and technology.

To better understand the meaning of a resource-based economy consider this: if all the money in the world were destroyed, as long as topsoil, factories, and other resources were left intact, we could build anything we choose to build and fulfill any human need. It is not money that people need; rather, it is free access to the necessities of life. In a resource-based economy , money would be irrelevant. All that would be required are the resources and the manufacturing and distribution of the products.

When education and resources are made available to all people without a price tag, there would be no limit to the human potential. Although this is difficult to imagine, even the wealthiest person today would be far better off in a resource based society as proposed by The Venus Project. Today the middle classes live better than kings of times past. In a resource based economy everyone would live better than the wealthiest of today.

In a resource based society, the measure of success would be based on the fulfillment of one's individual pursuits rather than the acquisition of wealth, property and power.

The Choice Is Ours To Make

Human behavior is subject to the same laws as any other natural phenomenon. Our customs, behaviors, and values are byproducts of our culture. No one is born with greed, prejudice, bigotry, patriotism and hatred; these are all learned behavior patterns. If the environment is unaltered, similar behavior will reoccur.

Today, much of the technology needed to bring about a global Resource Based Economy exists. If we choose to conform to the limitations of our present monetary-based economy, then it is likely that we will continue to live with its inevitable results: war, poverty, hunger, deprivation, crime, ignorance, stress, fear, and inequity. On the other hand, if we embrace the concept of a global resource-based economy , learn more about it, and share our understanding with our friends, this will help humanity evolve out of its present state.

Organisation supportrice en France :

Association Civilisation 2.0 - http://www.civilisation2.com

Sources : https://www.thevenusproject.com/en/store/official#!/~/product/category=1360103&id=5501756

https://www.thevenusproject.com/en/about/resume

Yves Herbo-MPSA, 13-01-2015

Foray into an area reserved too: money - Part 9

23/10/2014

Foray into an area reserved too: money - Part 9

Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7, Part 8

Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7, Part 8

VI

Appendix: Some practical remarks

The banking network

In practical terms, this transformation of the currency is no difficulty, especially in the age of computers, statistical software and accounting is now in common use.

As bank money is long, the new money is created by the increase in the assets of an account, and conversely, it is canceled by the diminution of that asset. The novelty is that these entries at any level whatsoever, can not legally be performed by public institutions with the sole function of keeping accounts of individuals and companies. This currency being only purchasing power, which can not be placed or created in order to bring interest, it has a nominal value of its creation, it is not transferable from one account to another, she remains on the same account until canceled. Banks are no longer the investment intermediaries, they no longer have the power to promote clients' multiplying the credit "against repayment with interest taken for their benefit. In other words, they do not make money by handling: managing accounts they perform a public service, such as, for example, marital status or social security, and obey a Central Bank whose decisions emanate from the only political power.

Every citizen has an account under his name, held by the bank of its choice. This personal account number can be number of social identity, which ensures that everyone has an account and a single. And that from birth, although as the owner is not an adult, who has charge of using his account to maintain and ensure their education.

Funding for the production

Today, in order to procure the means of production, a contractor on credit, usually through a commercial bank. With money "that can not relate," there are more private investors living in the interest derived from such advances, and it is the government's responsibility to provide the means of production.

What differences this transformation of money she leads?

There is none in the first stage: in both cases, whether the banker or the relevant economic services, the Contractor must encrypt their needs and convince him that his project is seriously considering the result it discount.

But in the first case, the banker is the sole judge, and his only concern is to ensure that the amount requested in advance if it has enough chances to be reimbursed and have more interests that requires. While in the second case, the economic department, because it is public and not interested in a private capacity, will be able to take into account other criteria such as environmental impact, noise, health, waste, pollution, and conservation of the common heritage, etc. One can imagine the creation in each commune councils to publish projects and to get the public interested in coming debate. We see that in so far as it is no longer only to make profit, it becomes possible to consider all the conditions in which production takes place. This public consultation can lead to discuss modes, methods and production rates, their impacts, site selection, energy, raw materials, the nature of the waste and how they are eliminated, etc. And even what happens to the company if it fails to prevent these deplorable Brownfields we see too often today and no one is responsible.

In both cases even when the project is accepted, the amount awarded is included in the enterprise, which will be charged to the account as the contractor will use to buy raw materials and to produce as provided.

It's then that things change.

When it comes to a loan capitalist currency, the contractor is deemed to own the wealth produced and he must find to sell as it is with the money from the sale to repay the loaned amount , he pays the interest, he pays expenses, taxes and duties. When he managed to pull enough of sale for the balance is positive, despite possibly advertising it pays well, it has a benefit. Otherwise, it is he who is the loser.

On the contrary, if the money was allocated in distributive currency contractor does not have to repay or pay interest, or advertising, or expenses, or taxes, or taxes because it does not own the wealth produced. He is contracted to deliver to retailers to be offered for sale at set prices. So he makes a public service by producing what he has committed to produce.

Now consider the renewal of the production process.

With capitalist money, the entrepreneur can hope to earn enough profit to be able to advance a share of more and more of its means of production, so have less need loans and, therefore, be increasingly free produce as they see fit ... if they can sell more. When it reached a certain size, the company becomes a shared between shareholders which are common owners of the means of production and wealth produced case; Their only concern is its profitability because the company is an investment, and all matters such as production methods, working conditions and pollution are generated, again and again, as seen from the perspective of reducing production costs for the sole purpose of increasing all the expected return of their investment. Even the utility of the products or the hazards involved in this, no longer matter as long as good publicity "communication" manages to attract customers! Customers and employees are put at the service of investors who also have grip on production.

Distributive currency can turn this logic, the relationship between producers and consumers no longer based on the submission of each other, for interest. The competition gave way to cooperation with terms when asked settled by consultation, the production contract linking the team of producers to the society in which they live, and which also includes clients for whom they s undertake to produce.

During the term of a contract, on behalf of the company is recharged automatically for continuous production. At maturity, the entrepreneur and his team are required to submit their balance sheet to the public to have a say if any renewal application for certain conditions can be adjusted as required.

Citizen participation

The economic department authority to create money needed for production companies to function plays so with the new currency, the role only investors and shareholders when money is capitalist.

By creating the same way the money required to run public services, the institution replaces the tax: distributive currency removes any levy taxes or any taxes since it is no longer necessary. This does not mean that everything is possible, since the flow of distributive currency is defined, so limited by the production.

Through this currency is thus the general population that invests in its businesses and puts his assets at their disposal, and it is this which sets out the broad guidelines on the production and distribution of wealth thus produced.

The company is therefore committed to a diametrically opposed to the liberal ideology that exalts selfishness by claiming that when everyone acts only according to its own personal interest way, the result is happiness for all through the miracle of the famous and mythical "invisible hand" ...!

The democratic organization made possible

The tasks to fulfill depend first of the broad economic policy. Regarding the production of goods, two extreme positions are unlikely to be adopted in a democratized economy or aberrant growth ideology, race in front of a consumer society that destroys non-renewable resources and compromises life on the planet, or a return to the Stone Age through systematic denial of the use of any technology.

The wisdom of nations will probably towards a balance between optimal use of the common heritage of science and nature reserves to allow maximum individual development, and the need to avoid compromising the ability of future generations to do even better, by building knowledge.

Further recall that distributive currency does not promote the proliferation of useless gadgets: when the sale is not motivated by profit manufacturer and seller, no one has more interest in pushing the gogo to accumulate.

For these reasons, the development of programmed machines ceasing to improve the production of material goods, especially in the final stage, will require fewer and fewer hours of human labor. The necessary jobs will thus proceed mainly in research and development services.

How to distribute these tasks?

The current distribution is made by the market: anyone who is not an inexhaustible fortune in his crib was forced to sell his personal qualities and his energy at the highest price in the labor market, and his life depends on it. This system can be seen, leads, when employment is scarce, precarity and exclusion for part of more and more of the population. Because it is based on selfishness it encourages, this pseudo-society is, again, a failure in human terms. Distributive currency helps rebuild the society based on solidarity, replacing the rat race by a long-term contract between the company and each of its members and can be summarized as follows: the company guarantees all citizens a decent income for a lifetime, it feels compelled to contribute, through its activities, to the extent of its resources and as required, to the corporation to ensure that all adequate standard of living.

Based on a clear principle as a modern democracy means, defining the modalities of its application, to let the people themselves choose their activities, betting on their diversity and the fact that a task is all the better fulfilled it has been selected and therefore corresponds to the aspirations and abilities of the person who committed it.

The purpose of education, reflection of society, has changed dramatically: it is no longer to form disciplined employees and bulimic clients, but future citizens able to think, judge, criticize and take responsibility, and, regardless of the time required for that, to help them reveal their talents, find their own way, then give them the training they need to develop, with a maximum of general knowledge, key to their autonomy of thought. Aware of the needs of the company who assured him such training, a young become full citizens by engaging in the activity of their choice. It may be associated with it for others to share the work of a certified business and whose resources will therefore be financed as noted above. Admittedly such a commitment can be made for a limited time, so be the subject of a 'civic' contract, after which the citizen will be able to apply for renewal or change its contract , or propose another, or taking a "sabbatical" year for personal reasons, or retrained, possibly to a different activity.

It is expected that at least initially, the opinion reject the idea that complete freedom is left to every individual and that all revenues are equal. It will be up to each region to provide certain quotas or standards, such as minimum or maximum service vacation, annual or longer periods. Let's not go into details because it is not about to freeze anything. Our intention is not to present "a whole package put together" would be the panacea, but to present what seems like another key development, open to any changes dynamics, free of dogmas and imperatives are now taxed when no ethics can justify.

Yves Herbo : it should be noted that the pre-Columbian civilizations of Central and South Americas have for millennia applied a system without liquid currency (except possibly to trade with "foreign") no, and huge spaces. Close enough to this system, citizens commanded their monthly lists of family and professional needs, and each citizen assured his task to produce and supply the needs of all who were grouped into communities and made available to continue to produce and live. Obviously, a royal family and priests abusing the system and ran, but the principle is fairly easily replaced by a democratic government if you think about it a bit ... there is evidence that the vast agricultural dynamics of the Incas, for example, enabled them improve their technicalities and to increase the number of persons engaged in research, astronomy, chemistry, etc. people ...

bibliography

Allais Maurice, La crise mondiale aujourd’hui, éd. Cl. Jouglar.

Bassoni Marc et A. Beltone, Monnaie. Théories et politiques, éd. Sirey, coll. synthése (1994).

Bernard Michel et M. Chartrand, Manifeste pour un revenu de citoyenneté, éd. du Renouveau

québécois (1999).

Béziade Monique, La monnaie et ses mécanismes, éd. La découverte, coll. Repéres, (1989).

Blanc Jérôme, Les monnaies parallèles, unité et diversité du fait monétaire, éd. L'Harmattan, coll.

Logiques économiques (2000).

Brown Lester R., Éco-économie. Une autre croissance est possible, écologique et durable, éd.

Seuil (2003).

calame Pierre et A. Talmant, L'État au coeur, éd. Desclées de Brower (1997).

Cartier Jean, La monnaie, éd. Flammarion Dominos (1996).

Castex Patrick, La monnaie : bâtarde de l'économie, enfant putatif du banquier, éd. L'Harmattan

(2003).

Chemineau Laurent (dirigé par), L'argent invisible. L'ère des flux électroniques, éd. Autrement

(1987).

Dévoluy Michel, Monnaie et problèmes financiers, éd. Hachette Supérieur, Les Fondamentaux,

(1994).

Dixon Keith, Les évangélistes du marché, éd. Raisons d'agir (1998).

Douglas C.H. Social credit, éd. Eyre & Spottiswood, Londres (1924 & 1933).

Duboin Jacques, Kou l'ahuri, ou la misère dans l'abondance, éd. Fustier (1935) et La Grande

Relève (1982).

Duboin Jacques, Libération, éd. Grasset (1937).

Duboin Jacques, Rareté et abondance, éd. Ocia (1944).

Duboin Jacques, L'économie politique de l'abondance, éd. Ocia, (1945).

Duboin Jacques, Les Yeux ouverts, éd. Jeheber, (1955).

Duboin Marie-Louise, Les affranchis de l'an 2000, éd. Syros (1982).

Fotopoulos Takis, Vers une démocratie générale, éd. Seuil (2002).

Galbraith John Keneth, L'argent traduction française de Money, whence it came, where it went, éd.

Gallimard, coll. folio Histoire, (1975).

Gauron André, Les remparts de l'argent, éd. Odile Jacob (1991).

Généreux Jacques, Les vraies lois de l'économie, éd. Seuil (2001).

Gorz André, Adieux au prolétariat, éd Galilée (1980).

Gorz André, Les chemins du Paradis. L'agonie du capital, éd. Galilée (1983).

Gorz André, Capitalisme, socialisme, écologie, éd. Galilée (1980).

Gorz André, Misère du présent, richesse du possible, éd. Galilée (1997).

Gorz André, L'immatériel, connaissance, valeur et capital, éd. Galilée (2003).

Gouverneur Jacques, Découvrir l'économie, éd. sociales (1998).

Hahnel Robin, La panique aux commandes, éd. Agone (2001).

Harribey Jean-Marie, La démence sénile du capital, fragments d'économie critique, éd. du Passant

(2002).

Himanen Pekka, L'éthique hacker et l'esprit de l'ère de l'information, éd. Exils (2001).

Issautier Marino-Bertil, Perspectives d'une révolution économique et monétaire, Revue Esprit-

Matière, (1961).

Jacquard Albert, J'accuse l'économie triomphante, éd. Calmann-Lévy (1998).

Keynes John-Maynard, The end of laissez-faire, essais traduits de l'anglais, éd. Agone, contre-feux

(1999).

Labarde Philippe et B. Maris, La Bourse ou la vie, éd. Albin Michel (2000).

Marcuse H., M. Barillon, A. Farrachi, T. Fotopoulos, M-L. Duboin, M.J. Frankman, J. Almendro, N.

Baillargeon, J. Luzi, P. Van Parijs, Utopies économiques éd. Agone N°21 (1999).

Maris Bernard, Antimanuel d'économie, éd. Bréal (2004).

Merlant P., R. Passet et J. Robin (sous la direction de) Sortir de l'économisme, éd. de l'atelier,

(2003)

Moulier-Boutang Yann, Garantir le revenu, Multitudes, N°8, (2002).

Papadia Francesco et C. Santini, La Banque centrale européenne, Banqueéditeur, 18 rue

Lafayette, 75009 Paris (1999).

Partant François, La fin du développement, Naissance d'une alternative ? éd. Maspéro, (1982).

Passet René, L'économique et le vivant, éd. Economica (1996).

Passet René, L'illusion néo-libérale, éd. Fayard (2000). et René, L'illusion néo-libérale, éd. Fayard (2000).

Passet René, Éloge du mondialisme, éd. Fayard (2001).

Passet René et J. Liberman Mondialisation financière et terrorisme, éd. indépendants, Enjeux-

planète (2002).

Pétrélla Ricardo, Le bien commun, Éloge de la solidarité, éd. Labor (1996).

Plihon Dominique, La monnaie et ses mécanismes, éd. La découverte, coll. Repéres (2000).

Plihon Dominique, Le nouveau capitalisme, éd. Flammarion, coll. Dominos, (2001).

Rizzo Pantaleo, L'économie sociale et solidaire face aux expérimentations monétaires, éd.

L'Harmattan (2003).

Robert Denis et E. Backes, Révélations, éd. Les arènes (2001).

Robin Jacques, Changer d'ère, éd. Seuil (1989).

Sapir Jacques, Les trous noirs de la science économique, Essai sur l'impossibilité de penser le

temps et l'argent, éd. Albin Michel (2000).

Sédillot Roger, Histoire morale et immorale de la monnaie, éd. Bordas culture, Paris (1989).

Soros George, Le défi de l'argent, éd. PLon (1996).

Soros George, La crise du capitalisme mondial, éd. PLon (1998).

Stiglitz Joseph E., Quand le capitalisme perd la tête, éd. Fayard (2003).

Sources : http://www.france.attac.org/

Yves Herbo, 23-10-2014

Foray into an area reserved too: money - Part 8

17/10/2014

Foray into an area reserved too: money - Part 8

Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7

Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7

part Two

Vb)

Liberation

"Who will tell the untold power of association when it turns into cooperation ...?" Jacques Duboin (Liberation)

By cons, it does not need to be an economist to see the result. The unlimited growth is unsustainable, its consequences are already such that it is the biological balance of the planet is in danger. What do foresaw few lucid minds there a few decades now seems the obvious: we can not continue this blind race. "No tree may climb to heaven!"

As for competitiveness, it leads to a profound social imbalance. This ongoing economic war which requires to be the best in anything, disinherit losers too little combative ... or who have not had the chance to be born among the privileged. By dint of promoting "the best" at the expense of all others, the tremendous advancement of knowledge and its technological applications has been put at the service of a tiny minority, while nearly 840 million people (YH: in 2003) (55) malnourished, lacking even a piece of land to grow their own hands to survive.

Both pitfalls of capitalist money

While the catastrophic effects of these imperatives for growth and competitiveness are increasingly evident, yet we continue to pretend unavoidable. And with such hollow arguments that "it is in the nature of things" or "this is how men work," without realizing how these two traps in which our civilization is lost, are contained in the existing mechanisms of the currency, which, however, are obviously not the laws of nature. Indeed:

• The requirement for growth is contained in the mode of creation of money: you have an investment worth more than it cost that can be paid the interest on the loan or "return on investment".

• The widening gap between rich and poor is contained in the choice of the customers to which credits are open, because a credit agency, to avoid being made bankrupt, requires collateral, mortgage, insurance. It can not lend to the rich and

the "snow-ball" effect of compounding, and only the rich can afford to get rich.

While the opinion is being gradually to become aware of the dangers of growth at all costs and is outraged to see that exploitation of resources can not be reduced, on the contrary, poverty in this world, it is clear that the monetary mechanisms are so poorly known that their relationship with this high productivity and individualism is not generally denounced. To believe that it is not even perceived.

This link will yet manifest. It manifests itself, for example by the public reaction against money in times of economic crisis we find that it is creating its own currency that minorities while trying to survive. The experiments that were launched in response to the Great Depression of the 1930s, those, for example, slush money Gesell or WIR circles, as well as those that are springing up everywhere from the liberal turn of the 1980s, by example in Argentina since 2002, are manifestations of the rejection of the official currency. But these parallel currencies, because they are topical, restricted, marginal, can, at best, that saving, but only for association members who create, some of the adverse effects they see.

And, secondly, how can we not see that everywhere money as mobile when large human catastrophes as we deplore the tainted blood, or environmental disasters such as oil spills or in gégazages sea, when we become aware of the effects of the commodification of public services and the patenting of life, or when you discover the power and role of pension funds, currency speculation and tax havens on economic choices, etc. I need regular. Money is the common denominator of all these inhuman behavior, it is indeed the common origin of these disasters that have nothing natural

And, secondly, how can we not see that everywhere money as mobile when large human catastrophes as we deplore the tainted blood, or environmental disasters such as oil spills or in gégazages sea, when we become aware of the effects of the commodification of public services and the patenting of life, or when you discover the power and role of pension funds, currency speculation and tax havens on economic choices, etc. I need regular. Money is the common denominator of all these inhuman behavior, it is indeed the common origin of these disasters that have nothing natural

This should help to understand that trying to fix it, when possible, the effects of these mechanisms does not help, as they renew indefinitely, or even increase, as is still common cause

Delete this cause is certainly not easy, but we must realize that it has become inevitable, it is the necessary condition to give the company bases other than those who are destroying it. But this reconstruction through a new transformation of money: for it no longer requires growth, it is necessary that its creation no longer requires payment of interest, and takes into account other criteria that profitability financial to make it possible to produce, in respect of the human rights and environment, goods and services accessible to all, without exclusion. No coup should this time be necessary to achieve such a transformation since, unlike the previous ones, it aims to increase the general interest before the interest of a few. But it is urgent to think about it, and it is to this end that we make the following three propositions.

First proposal: Return to the regality

Clearly, the intangible currency corresponds to the current state of technology, commodity money is over. It would be absurd to deny the virtual currency while dreaming of return of gold Louis exists, it is convenient, therefore accept without us linger, the currency of tomorrow will be in book-entry form, as it is almost completely today, smart cards and transactions transmitted over the internet going again develop.

But we must be aware of the danger of this modern form of money simply because it is naturally materially unlimited!

His creation is so easy that having abandoned the right to create money to private companies with their own interest objective, seems like an aberration, obvious source of many abuses of unpredictable consequences, incalculable. We have seen that when goldsmiths signed more than they had received gold in their cellars, their only limit was ... fear that their customers find that they had exaggerated Inefficient method, since several panics have marked history We also remember that when too many bankers have followed the example of goldsmiths, because they realized that it made them hurt that some of them were intrigued to get a monopoly And the history of central banks shows that it is still to prevent abuse, panic or bankruptcies they have received a certain power, not to set a limit on the money supply, but only an attempt by the through their discount rate, speed up or slow down the growth of the mass, hoping that these changes would ultimately affect the economy. And since these rates do not obey to the markets, we can not count the number of countries ruined by currency crises ... It is clear that political power should not be content to imagine dikes to prevent abuse or plug in the consequences, it is up to him to determine the necessary money to the economy

It is not without reason that the "right to coin money" was, par excellence, a prerogative of the sovereign, he is a part, under the monarchy, the "sovereign rights" with those to tax , ordered the police and the army, to render justice to declare war or to sign the end. Why any of these rights Prince has he done except when the people won sovereignty? We do not understand that democracies have abandoned some new preferred one of those essential rights that decide the life of a nation The right to create money is too important for it to be dissociated from the other attributes that are used to decide all on their behalf. (because they are not democracies!)

It must be returned to political power because a developed society, as it can be designed in the XXI century must be able to decide that it will meet the needs, according to the means available to it in respecting the rights of living human beings, and to come. From this perspective, if the essential choice for the overall direction of the economy is a fundamental political decision therefore can not be left to private interests.

Today the company serves finance, dictating policy to governments. Hand over responsibility for all money creation to the government, is to reverse the roles: the economic choices then become political choices and finance them subject.

But this is not enough. In a true democracy, entrust the economy to political power would be entrusted to the people, but the whole society, even in the XXI century, is not guaranteed to be democratic and to remain so. To put the economy at the service of all and keep it there, we need rules that prevent abuses by officials to issue paper, and for this, impose monetary limit mass concrete, objective.

Second proposal: Fix objectively money supply

Such a natural limit is simply the result of two aspects of money: it is a right to draw on the wealth produced and recognition of common debt as required by law to accept payment From these two facts leads to the following rule: representatives of a population, having a monopoly on creating the currency undertake in his name, can not issue the equivalent money to wealth and that this population produces sells

The creation of money and being committed to production, new production automatically create its equivalent in other currencies And, conversely, when a product reaches the consumer, money that he uses to buy it has served its purpose and has no reason to exist then it is canceled at the time of sale In other words, the currency becomes a parallel flow and equivalent to the wealth produced to be sold This is obviously an equivalence principle, which will result in practice, adjustments by calculations similar to those that stock computers do today to view quotes in a continuous and permanent.

But we must insist on another aspect For that equivalence is the origin of money creation, we need the price of a good or service offered for sale is evaluated when is committed to its production, rather than after, when it has already been produced This has the disadvantage of disrupting the habits, and the reflex is likely to believe, but a little faster, it comes to remove the market. All those who boast incessantly its irreplaceable merits rest assured, it is not at all to remove, but rather, to return him his virtues (56), that is to say, to allow the selling price of a good or service really is the result of a discussion between producers, sellers and consumers buyers.

But this is only if the democratic evaluation takes place upstream, so before it's too late, it is possible to discuss the modes of production, encourage or proscribe.

Specify, if necessary, that these discussions are intended to define the bases and not to fix prices each, one by one, and that one should provide margins of error and uncertainties, such as for agricultural production, which will result mathematics necessary changes described above. and add that this is not utopian, as evidenced by the Seikatsu, the producer-consumer associations and work in Japan for the past 20 years, or the Community supported agriculture (CSA), the consumer associations (57 ) pass contracts with farmers who purchase and before the season, part of their farm harvest.

Compared to the current situation, currency retains its role as a unit of account and means of payment, even offline. It is a purchasing power that is used only once because it is out of date when he served as a ticket or stamp, leaving its owner the ability to use it for any purchase of his choice. By cons, this reformed currency ceases to be a source of enrichment and inequality, so domination, where an appropriation not involve payment of interest.

Reorganized on this basis, the currency appears as a way to distribute it among all consumer goods and services produced by the economy of a region The logic of accumulation policy, ie accumulation, gives way to a logic of sharing, distribution

This reform, much simpler and more objective than those that have marked history, led to a turnaround: the law of the financial jungle that prevails today, it substitutes a social control of production, economic decisions-finances are finally subjected to reflection and policy debate, informed by surveys conducted objectively.

But until such a prior debate will not consider other aspects as profitability, the warnings of experts and warning cries against the dangers of the current high productivity can multiply indefinitely, they will only be wishful thinking. (see History 2007-2016)

With regard to international trade if the currency of a country (58) is the book event that residents commit themselves to produce (using human knowledge to grow the wealth of soil and sub soilless), trade relations between the two regions are only barter agreements between the two populations, the international exchange of goods are zero-sum and there is then a more international debt. It goes without saying that these contracts may include deadlines, their equity and their enforcement may be subject to supranational control, etc. The important thing is that this transformation of the bases of foreign trade would supply the population with the right to dispose of themselves, to ensure that their own vital priority sufficiency, "living in the country" and flourish developing their culture.

Our third proposal is inspired by what we have observed about the concept of value:

Third proposition: Separate property management from that of the people

We recalled that when economists speak of value, it is exchange value and that it is, in fact, the selling price of a commodity. Besides this award, as set today, no way the result of a debate as claimed by classical economics, but rather the law of the strongest, financially speaking, this approach compared to the standard what the single currency, which is measurable and what is not, leads to considering human labor as a commodity, a first among other matters, and finally the human being as a replaceable object, going to treat employees "like kleenex" in case of "redundancy", "false dismissals bankruptcies."

On the other hand, a little bit of insight predicts that the production of tomorrow will increasingly collective and intellectual work (59), which will make less use of labor, measurable (-ish) work time, and more and more human participation imponderable linked to the personality, culture, experience, imagination and creativity, qualities not measurable by gasoline. So pretend to estimate individual participation to buy it at a "fair price", "wages", becomes an absurdity or a scam.

To avoid this aberration, we must separate the management of people in the property. Do not mix in the same accounting being and having is bringing the economy to its natural place, that of stewardship. Let us not forget that the role of a production company is to transform the raw materials to make available to people the things they need, and that is not to provide employment, it is not create jobs to warrant income. The fact that the transformation of the material requires human intervention does not require treating "human resource" as a commodity, and it is separating materials accounting from humans that this distinction becomes possible and that be remembered that work and jobs are not the goals, but the means. Then only the income received by a human being will not be the price at which it sells to a company. We no longer talk about salary, price of sweat, but individual income based on personal needs and whose goal is to provide everyone with the means to develop their own skills to effectively perform the activities by which it assumes its participation in society. While this contribution may not be fully measurable and produce quality, even for the long term. Even if it means that income is paid by all of society and throughout life, not by companies, to those they employ, and only for the duration of the job.

In today's economy, money profit is used to "commodify" the field of the intangible. Encroaching this area of freedom, finance, submit it to profit and control or restricts access. The General Agreement on Trade in Services, GATS is being installed this appropriation of a common heritage of all mankind, makes knowledge slowly developed over history. Art and culture are some already standardized, it will soon be impossible for farmers to renew their crops, as they have done for so many generations, without buying new seeds from Monsanto. When will the obligation to buy the right to have their own offspring?

The reform we propose is to make it impossible that appropriation, making the currency the instrument of management only real. To separate what is naturally the domain of the economy, which is measurable and which must, in some cases, be "saved" so counted, and that which is the domain of the unmeasurable, the imponderable and intangible, that of knowledge, culture, information to be given without discard the use of which, far from having to be limited if it is not used to harm, shall be delivered besides, and thus be free.

These two areas are obviously not independent, since there is a link between them, man, who lives in the area of real and must flow freely in the area of intangible its own. But to the extent that the economy produces goods and not financial gain, where money is a stream that burns at the same time as the goods produced, it becomes possible to determine objectively the economy. So people can be grouped into a network of cooperatives of all sizes and all take objective decisions that affect them directly, since it is first to decide what to produce to consume and in what conditions this also defines their activity and the total money they have. It is then up to them in the budget and set the share paid for the material means of production, it is necessary to make public services and that which constitutes their personal income work.

The debate is largely open to the public and focus on public interest criteria. This is an extension of democracy to the economy that is available, allowing any resident to participate, if not always directly, at least by delegation to these decisions that are both social and economic.

(55) Read Passet, Financial Globalization and Terrorism

(56) Even the contrary, it is the financialization of the economy that has resulted from the virtues of the book market, to those professionals "Markets" (Stock and currency markets or other commodities , etc.) and remove them for the rest of the world, who is offered goods at prices fixed in advance by the seller: it's "take it or leave it", you do not market ...

(57) include the CSA model of Poughkeepsie, pre-installed in urban areas at a hundred miles north of New York and in France the Alliance peasant ecologists consumer network that brings together organizations working together to promote the development of ecological agriculture products quality.

(58) or a region or group of regions whose residents choose to associate economically.

(59) read about the deep analysis of André Gorz, for example in the immaterial, knowledge, value and capital.

Sources: http://www.france.attac.org/

To be continued for the last part: Appendix and Bibliography

Yves Herbo, 23-10-2014

Foray into an area reserved too: money - Part 7

14/10/2014

Foray into an area reserved too: money - Part 7

By definition, any form of payment is a currency. But the currency of a country is the only one that any citizen is required by law to accept payment in any other currency is a parallel currency (44), regardless of why it was created, the terms of its creation and distribution, unit of account, the extension of its use and whatever its methods of control.

Vouchers and other currencies "affected"

The most common parallel currencies, by far, consists of the vouchers.

These coins earmarked for a specific use, and restricted, can be created as good for a government to a category of population. This mode selective distribution discriminates between members of society and shows that it is "multi-speed".

These vouchers can be given to the poor, in the case of "Food stamps" in the United States. This distribution, designed to give them food aid, therefore requires a humiliating poor approach: they must apply for aid and justify stating their income too low (or no income); it may even be harmful, for example Milton Friedman had the idea of distributing vouchers teaching through which the state provides for children from poor families access to less expensive schools, so inferior education, and selection is on the registration fee, only wealthy families can afford the best schools. Such warrants are to privatize school while proclaiming that all children can access it.

Instead, vouchers can be distributed in the event of a shortage, at preferred to book their access to certain products become scarce. For example, petrol coupons were issued in Italy for foreigners, at a lower price than the price at the pump, when it was particularly high. It was to attract affluent tourists.

Specialized companies can manufacture and sell another type of affected currencies, this is the case, for example, meal vouchers. These companies make it advance to the employers who pay part of the salaries in this form. Employees who receive them so they can not spend their wages by depriving themselves of food. The advantage for employers is twofold: on the one hand, they benefit from tax and social security cuts when they use them, and secondly, their employees can not complain that their salary is not enough to feed them. These vouchers are used by 5 million employees in France.

Internet now allows the use of point systems that are, in fact, site-specific currencies including income from a share of advertising revenues and partly from the sale of customer information.

But the most popular vouchers are those traders distribute to customers they want to attract or "loyalty". To "capture" the client (? Trick or) their marketing science makes them invent all kinds of vouchers: chéques gift, sweepstakes, loyalty cards, promised benefits after several purchases, etc. Almost all brands of supermarkets offer loyalty cards free and all purchases (or only certain purchases) are eligible for points in addition to these cards and give a right or reductions later, or gifts according to scales that vary with the market chain. In all cases it is directing customers to particular products or loyalty to certain brands; it is always the push to buy, for example, if the points awarded cease to be valid after a period of time, obviously set by the chain. But it may happen that the gift promised not "available" ...

Examples of coupons, briefly consider the case of "miles" air, so common recently that they are called new world currency (45). Created in 1981 by American Airlines, these points are plotted on personal loyalty cards offered by airlines to their customers, and allow them to get free tickets in proportion to the distance traveled on their lines. For example, a flight from Paris to New York in economy class relates 7.280 miles (the distance in nautical miles) and gain that same flight must be purchased on the card, 50,000 miles. Airlines with fully integrated this use in their trade policy, they sell these "miles" to their partners on the ground (hotel chains, car rental companies, phone companies, etc.) who distribute, too, to their customers ; This assesses the current stock price of approximately 765 billion dollars, more than the total amount of coins and euro banknotes in circulation! In other words, these miles are the world's second currency in use, after the dollar! It was calculated that if the creation of a parallel currency continues to grow at the same rate, 20% per year since 1995, it will exceed the stock of greenbacks (USD) within two years. (2003 ...)

Note a feature of this world money: it does not circulate. When she once served, it is canceled.

She's so spent in customs in the United States that consumer groups are demanding the payment of interest on their miles, the IRS is considering imposing this extra pay provided to employees who travel for business (and often Highest paid) and that in some divorce proceedings the couple share the account of family miles. There is even now a black market for miles. But like any currency whose issue is not confronted with a physical value, it is a kind of time bomb: the companies have good stuff on the miles they issue, to anticipate what these miles will cost them Free tickets were beautiful predict that the majority of voucher recipients have not accumulated enough to qualify for free tickets, the fact remains that the world stock of miles held in this form by some 89 million airline customers was rated by the Economist in 2001 to 8.500 billion can be calculated that it would take 23 years to clear all the cards ... and provided stop-issue!

The use of vouchers business in one form or another distorts the market at least three ways:

First this practice neutralizes competition. For example, an airline miles program can give a company a dominant position.

Then use this information confuses price ultimately paid: what is the price per minute of mobile phone that works with a card that makes you such and such a price under certain conditions and such other rate as such? What is the price of a liter of petrol when any purchase of more than 10 liters is entitled to one good and so many good qualify for a free cleaning and nothing if the number is good enough? And what is the price of a flight paid by a company to its employees so that will take his card to pay for an upgrade to business class? Worse: Who will free acquired through the miles earned on professional employer paid tickets tickets? Such a question goes even further when the employer is the State and the traveler an MP two German MPs were forced to resign for using these free for family travel miles.

Finally the use of these warrants an immaterial impact or moral: customer becomes part of the capital (intangible) and these companies calculate the net present value (NPV) of a customer by the profits they anticipate purchases that will loyal if so, for example, it is known as "marketing" that "increase by 5% retention rate of customers increases the NPV of 35-95%" ...

Local currencies

When the economy of a country is failing, currency, economists are as a medium of exchange, is perceived by its residents as a barrier to trade. This leads them to seek ways to "get away" and react locally, unable to do so on a larger scale. Virtually all cases, the first initiative is to pass legal tender (which makes them default) by inventing a private currency, a parallel currency of their own, which is issued and controlled by themselves, and that has no other purpose than to allow them to live better or survive .

So in times of economic difficulties that arise from the experiences of local currencies.

A prime example is that of the Great Depression that began with the fall of the New York Stock Exchange in 1929 and lasted through the Great Depression until World War II.

She was described as a crisis of overproduction which for economists, does not mean that everyone was provided with the essentials, but that large quantities of products were not creditworthy buyers, because the millions of unemployed and their families, who were in great need, do not have money. It was the first manifestation of what Jacques Duboin denounced as "misery in abundance" (46).

The second followed the great neoliberal transformation that installed the dictatorship of the financial markets on the economy.

The post "Great Depression"

To accelerate the consumption Silvio Gesell imagined a depreciating currency, that is to say, tickets whose purchasing power, if he had not spent after a while, was systematically devalued at a rate of 0.5% per month or 6% per annum. Experiments have been conducted, the first to Worgel, a mountain village in Austria, and the second in France in Lignères-en-Berry, after the war. Both have resulted in a remarkable revival of the economy through consumption and both were ordered to stop claiming that the demurrage was illegal.

It is not surprising that the increase in unemployment in industrialized countries has prompted the re-emergence of such movements demanding a depreciating currency to boost the economy. A system running such a currency was experienced, for example, in Saint Quentin en Yvelines from 1 January 1997.

*

For the founders, in October 1934, the WIR Economic Circle (Ring Wirtshaft Gesellschaft), the same Great Depression was caused by a lack of supply of legal tender and should be avoided for small and medium businesses to suffer the consequences. It is therefore a system of exchange of goods between firms organized for profit by a sort of clearing house that charges a fee for each exchange and is also charge for services such as information, facilities credit and even lobbying governments to defend the interests of member companies.

The currency of this circle of mutual support can be exchanged between businesses that are members.

The after "Thirty Glorious"

Struck by the number of people who can not participate in economic and social life because they lack the money, Michael Linton created with some friends in 1982, the first local exchange trading system, English Local Exchange Trading Systems (LETS) to Vancouver (Canada). It will be copied first in Australia and New Zealand and the United Kingdom, etc. There are even more exchanges in a LETS he has a lot of members, so the challenge is to attract the world.

In France, the LETS (local exchange system) is gradually removed from the LETS system, since the first, held in 1994 in Ariege are associations of people who count, using a unit of account of their own, the transactions they make them, transactions involving both housework, repairs, childcare, making meals or language courses.

Offers and requests are listed in a catalog in which all members have access to a SEL. There are no notes in circulation, accounting takes place in an imaginary currency, each SEL has his own, the unit value, sometimes linked to the national currency but usually in the past tense, is the subject of mutual agreement. If Aurélie wishes repaint her kitchen while Peter offers to do painting, she gave him the job and they agree among themselves that it will allocate, for example, 10 hours. If their currency unit of account for the minute when the kitchen will be painted, the SEL will subtract 600 units of account and increase Aurélie especially that of Peter. It will then be Aurélie provide a job to a member of SALT, not necessarily Peter, and it will be entitled to 10 hours of assistance from a member of the SEL. The time is counted regardless of social or professional level of the person performing the service. There is no guarantee that the job will be done. No appeal is possible. Members are asked to limit their debt, but a deficit account is not penalized with interest. The accounts usually start at zero and members should limit their debt to the equivalent of -3000 minutes, for example. In other SEL, it immediately offers 5 hours from (300 units) to members to prevent them from starting on a debt.

Despite the availability of suitable computer programs, accounting for exchange units in the SEL ask them a vital problem for these accounts is very heavy and their leaders are forced to repetitive work. Gold traded in a work SEL are occasional principle, if it would work 'black'. The debate is whether to convert this task in paid work, so said, or make up less cumbersome to manage systems. Some SALT, much of the trade is not recorded, and the system then dissolves into the group of friends, but also loses its ability to regularly make new members "number", unlike SEL "count" in the SEL ask them a vital problem for these accounts is very heavy and their leaders are forced to repetitive work. Yet the work exchanged in an SEL are occasional principle, if it would work "to black ". debate is whether to convert this task in paid work, so said, or invent lighter to handle. some SALT, much of the trade is not recognized systems, and the system is then dissolved in the group of friends, but also loses its ability to regularly make new members "number", unlike SEL "count".

In 2003, in France, the number of SEL is the total number of members is estimated at 350 to 30,000, which would find, not the means to live, but more often topping up the opportunity to acquire a service that they would not have access otherwise, and they perform without fuss.

The system of exchange gardens universal (SET) works from books on which members record their transactions, independent pairs, these notebooks are shown only to the person who is sharing, there has no control.

The Ithaca-hour or time-dollar local currency born of the refusal of the 30,000 inhabitants of the city of Ithaca (upstate New York) to be subjected to the effects of decisions made far from large corporations not caring little survival of small communities. Its goal is to reorganize the local business economy, create local jobs and circulate locally income of its population. 30 cities in the United States, communities have formed to take advantage of these time-dollars, tax-free money that allows a help than an hour against an hour spent helping someone. He who receives a service to sign a certificate to that which makes him all these certificates is managed by a bank of time (time bank) that centralizes the offers and requests of time.

On the same principle, a group of Italian women created in Bologna in 1991, the first Italian bank time. This accounts, credit or debit, hours of women who intend to enhance their daily activities, it organizes their schedules based on the offers, requests and skills. This time banks have strong links with local governments, which are often even their origin and provide them necessary financial and premises.

Larger are the barter systems in South America. Argentina, whose natural resources are immense, residents found themselves almost overnight, without purchasing power because their domestic currency assets, their bank accounts, they were confiscated. A very large number of them surviving on these systems bartering goods, they happily held before the bankruptcy. In 1995, Bernal, a suburb of Buenos Aires, neighbors exchange the surplus of their gardens. They rediscover barter. On the local First, the system becomes regional and national levels. In three years, thousands of Argentines, victims of the crisis, and which do not receive unemployment insurance or family allowance, or an equivalent of the RMI, join clubs where barter exchange the goods or services.

Both producers and consumers, their club members receive a number of "creditos" (47), a sort of local currency that allows them to exchange products and services of the club. As trade in 1999 is estimated at more than $ 500 million in total. Today, these clubs are called "nodes" as they gathered in networks (Red de Trueque) extended to all of Argentina and even in neighboring countries (Uruguay, Brazil, Nicaragua, Peru, ...). These are not closed structures: people can move from one node to another. They come in various sizes, from a few dozen members to over a thousand. At first they came from the middle class, which grew into a class of new poor. With the extension of the crisis, and to cushion the effects on them, it would be over 6 million Argentines who, in 2002, participated in the activities of about 8,000 nodes.

Two major networks coexist: the Barter Network solidarity (RTS), which includes seventeen provinces and overall Barter Network (TMN) which has the largest number of members.

The government had to take into account the importance of these networks by 2000 barter was declared of national interest by the government. Moreover, many municipalities now accept that their constituents pay their taxes in creditos. In some cities traders or traditional service providers also accept regulations creditos. The principle is as follows: initially, a club makes a certain amount of money "alternative" and equally distributed among its members, who use it to swap them. If these exchanges are increasing to the point that members feel they need more money, they vote for a raise, for example, 10 units per member.

A close scrutiny of this inflation was necessary to avoid that the currency is devalued. Governments, particularly those in the city of Buenos Aires, have agreed to support this system as long as its currency is not convertible into currency.

But it was found that participants had difficulty not to confuse the currency "nodos" with the traditional currency and we must insist on the irrelevance of the cash value in the exchange system, which in fact corresponds mainly to the value of work. Finally, to avoid the inconvenience of counterfeits, it is recommended that major interclub exchanges are made into products rather than using different currencies. One wonders about the value of mixed systems combining traditional and alternative payment payment.

The proliferation of local currencies is not without its downside: it facilitates the massive falsification of the Notes (48) by mafia networks, and issue thoughtlessly creditos led to rampant inflation such as that in classical economics.

This is what is happening in the GTA. Heloisa Primavera (49), working with networks since 1996, especially denounced a "falsification of principle" because inflation in the GTA "is the result of over-issuing creditos in this network, which causes excess liquidity on the market. "It complains that the GTA to "destroy the economic and social dynamics of barter by flooding the country of its notes to create a centralized national network, the essential currency. The result is unfortunate: money is disconnected from the real economy. As a peso ... The fair correspondence between level of production and volume of outstanding creditos is broken, the credito loses its value and above all the trust of users "(50). That is why she is campaigning to the mayors that they will not accept any local currency. For her, it is urgent to strengthen the potential of alternative barter "must become the ground of an economy of abundance where the game is not won / lost, as in capitalism, but wins / win, thanks to the effective sharing of wealth. ""Barter is for the first time, a way to lift the poor out of the exclusion without war, without taking up arms [...] It is something pioneering and no regression". "We are at a point of exit from the paradigm of scarcity and into the realm of abundance. There is no scarcity. It is artificial "(51).

*

Many other local currencies were invented, they are too numerous to be mentioned, since smoking and playing cards replacing the legal currency in colonial United States, to those that currently abound in the world . For example, "In Brazil, the municipality of Braga decided to pay its employees by printing its own banknotes. Baptized "Bonus", tickets can be used to pay local taxes and are accepted in shops of the city "(52). Or "In Russia, in the Novosibirsk region, a company prints its own currency. More than 800,000 tickets with a face value of one ruble were published and distributed to employees This issue allowed to pay three months' salary late ... Only three shops and a gas station, also belonging to the company in question can exchange goods against these bills, which are also accepted by local authorities in payment of local taxes, while paying their municipal officials with these tickets "(53). And also in Italy (Rete di economia local), Germany (Tauschring), Japan, Thailand (Thailand Community currency systems), New Guinea, Indonesia etc.

*

These exchange networks recreate the social link, and oppose and, in fact, the current economic system that enhances and develops the individualism of "every man for himself", and even gratifies. Neoliberal governments might be tempted to see in their development the way to get rid of them the problem of survival excluded from the competition. But they lie in wait rather with the trap of "moonlighting", as services traded between them by members of a network of trade does not result in payment of taxes, especially because professional merchant services complain that they are competing with them and see them as shortfalls.

Another reason given for the sentence is to say that the currencies they create are illegal. This is strictly true, but then why all private currencies, all other parallel currencies, the most numerous are those emitted by commercial channels, are they not banned long under the same argument? It seems surprising that no lawyer has been able to denounce the denial of justice which is to say that an illegal currency is tolerable when it is purely profit-oriented but becomes intolerable when its sole purpose is to create solidarity.

Move from local to global

All of these use of local currencies were born almost spontaneously, in an emergency:

serious economic and social problem is revealed, then experiments are launched in an attempt to overcome locally, immediate and pragmatic. But even if their design is not universal, always acting with specific agreements for a few hours of work that remains limited to the field of crafts, and even if they allow the recovery remains self-centered, these networks are very effective socially: breaking anonymity conveyed by the capitalist currency, they create relationships between their members as the market, on the contrary, develops selfishness of "every man for himself." So, regardless of how it will evolve, it is important for the economy of tomorrow adopted the slogan: "The link is better than good" and it is organized to encourage and develop these locally "exchange of best practices ", both recognized and they will not be.

But the economy of human society is not limited to the local level. Not only was he services (transport, water, energy, heavy medical care, basic research, information, culture, heritage maintenance, etc., and justice, for life in society requires a code that must be enforce without this turns reckoning ...) that must remain organized on a much larger public scale, the regional minimum. Even national, such as caring for an aging population. Internationally, the SEL can not, for example, prevent the drug trade, or constrain the development of violence engendered by misery created by capitalism. And even staying on a small scale, it often produces better individually when we agree to work in teams so that all benefits from the skills of all, loosely coupled intelligently organize their cooperation. An infrastructure is needed, which is part of a larger-scale organization, supporting other needs than those who are set by individual exchanges, even multilateral.

There is another reason, more important, which is that there is urgency to have the courage to innovate, as did the SEL locally, but thinking globally and acting for the whole society. Is that humanity is immersed in a real change; heirs of expertise and knowledge accumulated over thousands of years, we know now produce everything, even the worst. Yet it is often the worst product in today's economy, by setting markets work of a minority that feels free to monopolize all resources. And also produces anyhow. It is therefore urgent to reflect on another transformation of money that would guide modern economies to ensure mankind a more dignified and secure future. Such is the meaning of the findings qu'Héloïsa Primavera draws from his own experience in Argentina when it focuses on the fact that capitalism is an economy of scarcity but is unable to share the wealth as we are entering a era of abundance.

It is in this truly humanist aspiration, as bearer of a project for the whole of society, as are the two types of proposals.

The social dividend

In the early 1930s, the proposals of the Scottish Major CHDouglas had national social significance, if not universal. Putting the arbitrariness of money creation by banks causing the lack of purchasing power of the poor, also condemned unemployed by mechanization, he pointed out that the true wealth of a country is not not indicated that its financial system but its real potential to produce: its land, mines, roads and know-how. This heritage is common to all the citizens of a country, he considered legitimate for each regularly hits the dividend in the form of a sum paid annually by a national credit agency issuing a new currency for it. Yet applied this principle in Alaska has earned all the inhabitants of this American state, man, woman or child to receive a dividend in 2002 to $ 1,540 oil-collateralized basement.

The SOL project

The project of a united currency, SOL, is designed to promote an inclusive society with the human rather than the profit objective.

Specifically, a citizenship would be SOL on specific goods and services in the social and solidarity economy (SSE: mutuals, cooperatives, for example) or by having a civic behavior by getting involved in social life (literacy volunteer , for example). These allow SOL to purchase goods and services of SSE (fair trade, insurance or even financial investments), access to public goods (sports equipment a common example) and cultural or supporting local initiatives or large community causes.

This initiative is part of many current experiments in the search for a social economy, analyzed by Pantaleo Rizzo (54). It is the blatant demonstration of the need to escape the imperatives of capitalism that now dominates the world, but it faces its own limits if it is to put up with this system and not to seek ways replace it.

(44) Jerome White, Parallel currencies, unity and diversity owing money.

(45) See Le Monde, August 20, 2002, page 11.

(46) subtitle of his book "Kou, the bewildered," which was first published in 1934 and, 62 years later, as the misery in abundance he described was, alas, yet news, it was staged at the theater by Christine Delmotte in Belgium and Paris. Jacques Duboin great humanist, was brought in the great crisis of 1929, to explain the nature of the change in civilization which then was beginning, and the need to conclude a distribution economy then it defines as Économie Distributive name.

(47) In fact, there are several versions of credito corresponding to regions of origin, but they flow easily into the country.

(48) Some creditos now carry watermarks and serial numbers.

(49) Professor of Public Administration at the University of Buenos Aires.

(50) in Christian Testimony, No. 3030, 3/10/2002.

(51) Heloisa Primavera, International Meeting "Reconsider wealth", Paris, 1-2 / 3/2002.

(52) Marianne week 25-31 / 1/1999.

(53) Le Midi Libre, of 13.03.1999.

(54) P. Rizzo, The social and solidarity economy to monetary experiments. http://www.docstoc.com/docs/91268733/Pantaleo-RIZZO

Sources: http://www.france.attac.org/

Continued to Part 2

Yves Herbo, 14-10-2014

Foray into an area reserved too: money - Part 6

12/10/2014

Foray into an area reserved too: money - Part 6

Part IV Part Two

Part 1, Part 2, Part 3, Part 4, Part 5

"Come and help me! Whoever made it clear to his fellow man the meaning of these words is the unknown founder of all human societies."

Jacques Duboin (Liberation)

IVb

Currency and Society