Foray into an area reserved too: money - Part 7

By definition, any form of payment is a currency. But the currency of a country is the only one that any citizen is required by law to accept payment in any other currency is a parallel currency (44), regardless of why it was created, the terms of its creation and distribution, unit of account, the extension of its use and whatever its methods of control.

Vouchers and other currencies "affected"

The most common parallel currencies, by far, consists of the vouchers.

These coins earmarked for a specific use, and restricted, can be created as good for a government to a category of population. This mode selective distribution discriminates between members of society and shows that it is "multi-speed".

These vouchers can be given to the poor, in the case of "Food stamps" in the United States. This distribution, designed to give them food aid, therefore requires a humiliating poor approach: they must apply for aid and justify stating their income too low (or no income); it may even be harmful, for example Milton Friedman had the idea of distributing vouchers teaching through which the state provides for children from poor families access to less expensive schools, so inferior education, and selection is on the registration fee, only wealthy families can afford the best schools. Such warrants are to privatize school while proclaiming that all children can access it.

Instead, vouchers can be distributed in the event of a shortage, at preferred to book their access to certain products become scarce. For example, petrol coupons were issued in Italy for foreigners, at a lower price than the price at the pump, when it was particularly high. It was to attract affluent tourists.

Specialized companies can manufacture and sell another type of affected currencies, this is the case, for example, meal vouchers. These companies make it advance to the employers who pay part of the salaries in this form. Employees who receive them so they can not spend their wages by depriving themselves of food. The advantage for employers is twofold: on the one hand, they benefit from tax and social security cuts when they use them, and secondly, their employees can not complain that their salary is not enough to feed them. These vouchers are used by 5 million employees in France.

Internet now allows the use of point systems that are, in fact, site-specific currencies including income from a share of advertising revenues and partly from the sale of customer information.

But the most popular vouchers are those traders distribute to customers they want to attract or "loyalty". To "capture" the client (? Trick or) their marketing science makes them invent all kinds of vouchers: chéques gift, sweepstakes, loyalty cards, promised benefits after several purchases, etc. Almost all brands of supermarkets offer loyalty cards free and all purchases (or only certain purchases) are eligible for points in addition to these cards and give a right or reductions later, or gifts according to scales that vary with the market chain. In all cases it is directing customers to particular products or loyalty to certain brands; it is always the push to buy, for example, if the points awarded cease to be valid after a period of time, obviously set by the chain. But it may happen that the gift promised not "available" ...

Examples of coupons, briefly consider the case of "miles" air, so common recently that they are called new world currency (45). Created in 1981 by American Airlines, these points are plotted on personal loyalty cards offered by airlines to their customers, and allow them to get free tickets in proportion to the distance traveled on their lines. For example, a flight from Paris to New York in economy class relates 7.280 miles (the distance in nautical miles) and gain that same flight must be purchased on the card, 50,000 miles. Airlines with fully integrated this use in their trade policy, they sell these "miles" to their partners on the ground (hotel chains, car rental companies, phone companies, etc.) who distribute, too, to their customers ; This assesses the current stock price of approximately 765 billion dollars, more than the total amount of coins and euro banknotes in circulation! In other words, these miles are the world's second currency in use, after the dollar! It was calculated that if the creation of a parallel currency continues to grow at the same rate, 20% per year since 1995, it will exceed the stock of greenbacks (USD) within two years. (2003 ...)

Note a feature of this world money: it does not circulate. When she once served, it is canceled.

She's so spent in customs in the United States that consumer groups are demanding the payment of interest on their miles, the IRS is considering imposing this extra pay provided to employees who travel for business (and often Highest paid) and that in some divorce proceedings the couple share the account of family miles. There is even now a black market for miles. But like any currency whose issue is not confronted with a physical value, it is a kind of time bomb: the companies have good stuff on the miles they issue, to anticipate what these miles will cost them Free tickets were beautiful predict that the majority of voucher recipients have not accumulated enough to qualify for free tickets, the fact remains that the world stock of miles held in this form by some 89 million airline customers was rated by the Economist in 2001 to 8.500 billion can be calculated that it would take 23 years to clear all the cards ... and provided stop-issue!

The use of vouchers business in one form or another distorts the market at least three ways:

First this practice neutralizes competition. For example, an airline miles program can give a company a dominant position.

Then use this information confuses price ultimately paid: what is the price per minute of mobile phone that works with a card that makes you such and such a price under certain conditions and such other rate as such? What is the price of a liter of petrol when any purchase of more than 10 liters is entitled to one good and so many good qualify for a free cleaning and nothing if the number is good enough? And what is the price of a flight paid by a company to its employees so that will take his card to pay for an upgrade to business class? Worse: Who will free acquired through the miles earned on professional employer paid tickets tickets? Such a question goes even further when the employer is the State and the traveler an MP two German MPs were forced to resign for using these free for family travel miles.

Finally the use of these warrants an immaterial impact or moral: customer becomes part of the capital (intangible) and these companies calculate the net present value (NPV) of a customer by the profits they anticipate purchases that will loyal if so, for example, it is known as "marketing" that "increase by 5% retention rate of customers increases the NPV of 35-95%" ...

Local currencies

When the economy of a country is failing, currency, economists are as a medium of exchange, is perceived by its residents as a barrier to trade. This leads them to seek ways to "get away" and react locally, unable to do so on a larger scale. Virtually all cases, the first initiative is to pass legal tender (which makes them default) by inventing a private currency, a parallel currency of their own, which is issued and controlled by themselves, and that has no other purpose than to allow them to live better or survive .

So in times of economic difficulties that arise from the experiences of local currencies.

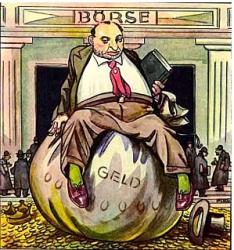

A prime example is that of the Great Depression that began with the fall of the New York Stock Exchange in 1929 and lasted through the Great Depression until World War II.

She was described as a crisis of overproduction which for economists, does not mean that everyone was provided with the essentials, but that large quantities of products were not creditworthy buyers, because the millions of unemployed and their families, who were in great need, do not have money. It was the first manifestation of what Jacques Duboin denounced as "misery in abundance" (46).

The second followed the great neoliberal transformation that installed the dictatorship of the financial markets on the economy.

The post "Great Depression"

To accelerate the consumption Silvio Gesell imagined a depreciating currency, that is to say, tickets whose purchasing power, if he had not spent after a while, was systematically devalued at a rate of 0.5% per month or 6% per annum. Experiments have been conducted, the first to Worgel, a mountain village in Austria, and the second in France in Lignères-en-Berry, after the war. Both have resulted in a remarkable revival of the economy through consumption and both were ordered to stop claiming that the demurrage was illegal.

It is not surprising that the increase in unemployment in industrialized countries has prompted the re-emergence of such movements demanding a depreciating currency to boost the economy. A system running such a currency was experienced, for example, in Saint Quentin en Yvelines from 1 January 1997.

*

For the founders, in October 1934, the WIR Economic Circle (Ring Wirtshaft Gesellschaft), the same Great Depression was caused by a lack of supply of legal tender and should be avoided for small and medium businesses to suffer the consequences. It is therefore a system of exchange of goods between firms organized for profit by a sort of clearing house that charges a fee for each exchange and is also charge for services such as information, facilities credit and even lobbying governments to defend the interests of member companies.

The currency of this circle of mutual support can be exchanged between businesses that are members.

The after "Thirty Glorious"

Struck by the number of people who can not participate in economic and social life because they lack the money, Michael Linton created with some friends in 1982, the first local exchange trading system, English Local Exchange Trading Systems (LETS) to Vancouver (Canada). It will be copied first in Australia and New Zealand and the United Kingdom, etc. There are even more exchanges in a LETS he has a lot of members, so the challenge is to attract the world.

In France, the LETS (local exchange system) is gradually removed from the LETS system, since the first, held in 1994 in Ariege are associations of people who count, using a unit of account of their own, the transactions they make them, transactions involving both housework, repairs, childcare, making meals or language courses.

Offers and requests are listed in a catalog in which all members have access to a SEL. There are no notes in circulation, accounting takes place in an imaginary currency, each SEL has his own, the unit value, sometimes linked to the national currency but usually in the past tense, is the subject of mutual agreement. If Aurélie wishes repaint her kitchen while Peter offers to do painting, she gave him the job and they agree among themselves that it will allocate, for example, 10 hours. If their currency unit of account for the minute when the kitchen will be painted, the SEL will subtract 600 units of account and increase Aurélie especially that of Peter. It will then be Aurélie provide a job to a member of SALT, not necessarily Peter, and it will be entitled to 10 hours of assistance from a member of the SEL. The time is counted regardless of social or professional level of the person performing the service. There is no guarantee that the job will be done. No appeal is possible. Members are asked to limit their debt, but a deficit account is not penalized with interest. The accounts usually start at zero and members should limit their debt to the equivalent of -3000 minutes, for example. In other SEL, it immediately offers 5 hours from (300 units) to members to prevent them from starting on a debt.

Despite the availability of suitable computer programs, accounting for exchange units in the SEL ask them a vital problem for these accounts is very heavy and their leaders are forced to repetitive work. Gold traded in a work SEL are occasional principle, if it would work 'black'. The debate is whether to convert this task in paid work, so said, or make up less cumbersome to manage systems. Some SALT, much of the trade is not recorded, and the system then dissolves into the group of friends, but also loses its ability to regularly make new members "number", unlike SEL "count" in the SEL ask them a vital problem for these accounts is very heavy and their leaders are forced to repetitive work. Yet the work exchanged in an SEL are occasional principle, if it would work "to black ". debate is whether to convert this task in paid work, so said, or invent lighter to handle. some SALT, much of the trade is not recognized systems, and the system is then dissolved in the group of friends, but also loses its ability to regularly make new members "number", unlike SEL "count".

In 2003, in France, the number of SEL is the total number of members is estimated at 350 to 30,000, which would find, not the means to live, but more often topping up the opportunity to acquire a service that they would not have access otherwise, and they perform without fuss.

The system of exchange gardens universal (SET) works from books on which members record their transactions, independent pairs, these notebooks are shown only to the person who is sharing, there has no control.

The Ithaca-hour or time-dollar local currency born of the refusal of the 30,000 inhabitants of the city of Ithaca (upstate New York) to be subjected to the effects of decisions made far from large corporations not caring little survival of small communities. Its goal is to reorganize the local business economy, create local jobs and circulate locally income of its population. 30 cities in the United States, communities have formed to take advantage of these time-dollars, tax-free money that allows a help than an hour against an hour spent helping someone. He who receives a service to sign a certificate to that which makes him all these certificates is managed by a bank of time (time bank) that centralizes the offers and requests of time.

On the same principle, a group of Italian women created in Bologna in 1991, the first Italian bank time. This accounts, credit or debit, hours of women who intend to enhance their daily activities, it organizes their schedules based on the offers, requests and skills. This time banks have strong links with local governments, which are often even their origin and provide them necessary financial and premises.

Larger are the barter systems in South America. Argentina, whose natural resources are immense, residents found themselves almost overnight, without purchasing power because their domestic currency assets, their bank accounts, they were confiscated. A very large number of them surviving on these systems bartering goods, they happily held before the bankruptcy. In 1995, Bernal, a suburb of Buenos Aires, neighbors exchange the surplus of their gardens. They rediscover barter. On the local First, the system becomes regional and national levels. In three years, thousands of Argentines, victims of the crisis, and which do not receive unemployment insurance or family allowance, or an equivalent of the RMI, join clubs where barter exchange the goods or services.

Both producers and consumers, their club members receive a number of "creditos" (47), a sort of local currency that allows them to exchange products and services of the club. As trade in 1999 is estimated at more than $ 500 million in total. Today, these clubs are called "nodes" as they gathered in networks (Red de Trueque) extended to all of Argentina and even in neighboring countries (Uruguay, Brazil, Nicaragua, Peru, ...). These are not closed structures: people can move from one node to another. They come in various sizes, from a few dozen members to over a thousand. At first they came from the middle class, which grew into a class of new poor. With the extension of the crisis, and to cushion the effects on them, it would be over 6 million Argentines who, in 2002, participated in the activities of about 8,000 nodes.

Two major networks coexist: the Barter Network solidarity (RTS), which includes seventeen provinces and overall Barter Network (TMN) which has the largest number of members.

The government had to take into account the importance of these networks by 2000 barter was declared of national interest by the government. Moreover, many municipalities now accept that their constituents pay their taxes in creditos. In some cities traders or traditional service providers also accept regulations creditos. The principle is as follows: initially, a club makes a certain amount of money "alternative" and equally distributed among its members, who use it to swap them. If these exchanges are increasing to the point that members feel they need more money, they vote for a raise, for example, 10 units per member.

A close scrutiny of this inflation was necessary to avoid that the currency is devalued. Governments, particularly those in the city of Buenos Aires, have agreed to support this system as long as its currency is not convertible into currency.

But it was found that participants had difficulty not to confuse the currency "nodos" with the traditional currency and we must insist on the irrelevance of the cash value in the exchange system, which in fact corresponds mainly to the value of work. Finally, to avoid the inconvenience of counterfeits, it is recommended that major interclub exchanges are made into products rather than using different currencies. One wonders about the value of mixed systems combining traditional and alternative payment payment.

The proliferation of local currencies is not without its downside: it facilitates the massive falsification of the Notes (48) by mafia networks, and issue thoughtlessly creditos led to rampant inflation such as that in classical economics.

This is what is happening in the GTA. Heloisa Primavera (49), working with networks since 1996, especially denounced a "falsification of principle" because inflation in the GTA "is the result of over-issuing creditos in this network, which causes excess liquidity on the market. "It complains that the GTA to "destroy the economic and social dynamics of barter by flooding the country of its notes to create a centralized national network, the essential currency. The result is unfortunate: money is disconnected from the real economy. As a peso ... The fair correspondence between level of production and volume of outstanding creditos is broken, the credito loses its value and above all the trust of users "(50). That is why she is campaigning to the mayors that they will not accept any local currency. For her, it is urgent to strengthen the potential of alternative barter "must become the ground of an economy of abundance where the game is not won / lost, as in capitalism, but wins / win, thanks to the effective sharing of wealth. ""Barter is for the first time, a way to lift the poor out of the exclusion without war, without taking up arms [...] It is something pioneering and no regression". "We are at a point of exit from the paradigm of scarcity and into the realm of abundance. There is no scarcity. It is artificial "(51).

*

Many other local currencies were invented, they are too numerous to be mentioned, since smoking and playing cards replacing the legal currency in colonial United States, to those that currently abound in the world . For example, "In Brazil, the municipality of Braga decided to pay its employees by printing its own banknotes. Baptized "Bonus", tickets can be used to pay local taxes and are accepted in shops of the city "(52). Or "In Russia, in the Novosibirsk region, a company prints its own currency. More than 800,000 tickets with a face value of one ruble were published and distributed to employees This issue allowed to pay three months' salary late ... Only three shops and a gas station, also belonging to the company in question can exchange goods against these bills, which are also accepted by local authorities in payment of local taxes, while paying their municipal officials with these tickets "(53). And also in Italy (Rete di economia local), Germany (Tauschring), Japan, Thailand (Thailand Community currency systems), New Guinea, Indonesia etc.

*

These exchange networks recreate the social link, and oppose and, in fact, the current economic system that enhances and develops the individualism of "every man for himself", and even gratifies. Neoliberal governments might be tempted to see in their development the way to get rid of them the problem of survival excluded from the competition. But they lie in wait rather with the trap of "moonlighting", as services traded between them by members of a network of trade does not result in payment of taxes, especially because professional merchant services complain that they are competing with them and see them as shortfalls.

Another reason given for the sentence is to say that the currencies they create are illegal. This is strictly true, but then why all private currencies, all other parallel currencies, the most numerous are those emitted by commercial channels, are they not banned long under the same argument? It seems surprising that no lawyer has been able to denounce the denial of justice which is to say that an illegal currency is tolerable when it is purely profit-oriented but becomes intolerable when its sole purpose is to create solidarity.

Move from local to global

All of these use of local currencies were born almost spontaneously, in an emergency:

serious economic and social problem is revealed, then experiments are launched in an attempt to overcome locally, immediate and pragmatic. But even if their design is not universal, always acting with specific agreements for a few hours of work that remains limited to the field of crafts, and even if they allow the recovery remains self-centered, these networks are very effective socially: breaking anonymity conveyed by the capitalist currency, they create relationships between their members as the market, on the contrary, develops selfishness of "every man for himself." So, regardless of how it will evolve, it is important for the economy of tomorrow adopted the slogan: "The link is better than good" and it is organized to encourage and develop these locally "exchange of best practices ", both recognized and they will not be.

But the economy of human society is not limited to the local level. Not only was he services (transport, water, energy, heavy medical care, basic research, information, culture, heritage maintenance, etc., and justice, for life in society requires a code that must be enforce without this turns reckoning ...) that must remain organized on a much larger public scale, the regional minimum. Even national, such as caring for an aging population. Internationally, the SEL can not, for example, prevent the drug trade, or constrain the development of violence engendered by misery created by capitalism. And even staying on a small scale, it often produces better individually when we agree to work in teams so that all benefits from the skills of all, loosely coupled intelligently organize their cooperation. An infrastructure is needed, which is part of a larger-scale organization, supporting other needs than those who are set by individual exchanges, even multilateral.

There is another reason, more important, which is that there is urgency to have the courage to innovate, as did the SEL locally, but thinking globally and acting for the whole society. Is that humanity is immersed in a real change; heirs of expertise and knowledge accumulated over thousands of years, we know now produce everything, even the worst. Yet it is often the worst product in today's economy, by setting markets work of a minority that feels free to monopolize all resources. And also produces anyhow. It is therefore urgent to reflect on another transformation of money that would guide modern economies to ensure mankind a more dignified and secure future. Such is the meaning of the findings qu'Héloïsa Primavera draws from his own experience in Argentina when it focuses on the fact that capitalism is an economy of scarcity but is unable to share the wealth as we are entering a era of abundance.

It is in this truly humanist aspiration, as bearer of a project for the whole of society, as are the two types of proposals.

The social dividend

In the early 1930s, the proposals of the Scottish Major CHDouglas had national social significance, if not universal. Putting the arbitrariness of money creation by banks causing the lack of purchasing power of the poor, also condemned unemployed by mechanization, he pointed out that the true wealth of a country is not not indicated that its financial system but its real potential to produce: its land, mines, roads and know-how. This heritage is common to all the citizens of a country, he considered legitimate for each regularly hits the dividend in the form of a sum paid annually by a national credit agency issuing a new currency for it. Yet applied this principle in Alaska has earned all the inhabitants of this American state, man, woman or child to receive a dividend in 2002 to $ 1,540 oil-collateralized basement.

The SOL project

The project of a united currency, SOL, is designed to promote an inclusive society with the human rather than the profit objective.

Specifically, a citizenship would be SOL on specific goods and services in the social and solidarity economy (SSE: mutuals, cooperatives, for example) or by having a civic behavior by getting involved in social life (literacy volunteer , for example). These allow SOL to purchase goods and services of SSE (fair trade, insurance or even financial investments), access to public goods (sports equipment a common example) and cultural or supporting local initiatives or large community causes.

This initiative is part of many current experiments in the search for a social economy, analyzed by Pantaleo Rizzo (54). It is the blatant demonstration of the need to escape the imperatives of capitalism that now dominates the world, but it faces its own limits if it is to put up with this system and not to seek ways replace it.

(44) Jerome White, Parallel currencies, unity and diversity owing money.

(45) See Le Monde, August 20, 2002, page 11.

(46) subtitle of his book "Kou, the bewildered," which was first published in 1934 and, 62 years later, as the misery in abundance he described was, alas, yet news, it was staged at the theater by Christine Delmotte in Belgium and Paris. Jacques Duboin great humanist, was brought in the great crisis of 1929, to explain the nature of the change in civilization which then was beginning, and the need to conclude a distribution economy then it defines as Économie Distributive name.

(47) In fact, there are several versions of credito corresponding to regions of origin, but they flow easily into the country.

(48) Some creditos now carry watermarks and serial numbers.

(49) Professor of Public Administration at the University of Buenos Aires.

(50) in Christian Testimony, No. 3030, 3/10/2002.

(51) Heloisa Primavera, International Meeting "Reconsider wealth", Paris, 1-2 / 3/2002.

(52) Marianne week 25-31 / 1/1999.

(53) Le Midi Libre, of 13.03.1999.

(54) P. Rizzo, The social and solidarity economy to monetary experiments. http://www.docstoc.com/docs/91268733/Pantaleo-RIZZO

Sources: http://www.france.attac.org/

Continued to Part 2

Yves Herbo, 14-10-2014